The system for awarding an FE Crown rating was introduced in September 2011 and has come to represent an important fund selection metric for financial advisers.

It forms part of threesixty Unit Trust and OEIC fund selection process, which has a requirement for 3 FE Crowns. The FE Crown rating is reviewed by FE Analytics Bi-annually in January and July. To be considered for a rating, a fund needs to meet the following criteria:

- The fund has been established for at least 3 years

- Is an actively managed fund

- Sits outside the unclassified, absolute return or structured product sectors.

Once a fund meets the above criteria FE assess a funds’ alpha, relative volatility and consistency of performance against an applicable benchmark. Funds are grouped into eleven sub-asset classes; scores are aggregated and tiered 1 to 5 Crowns based on these total scores.

It is important to note adviser firms understand this methodology before using it as a rating. Any research input into an investment committee will also need to consider the schedule for rating reviews. Due diligence on a rating used needs to be documented as part of a centralised investment proposition to assess where a tool is useful and what are its limitations. Many of our clients will use a combination of fund metrics to provide confirmation and to compliment the rating.

July review

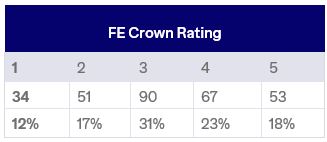

Post our July 2024 fund review the composition of Active funds by FE crown rating was as follows:

FE Crown rating

At the latest review, threesixty’s fund shortlist had 295 candidates with an FE Crown rating. 71% met criteria, but 29% didn’t. One of the challenges with any rating is not all funds will be top performers at any one time; different investment sectors, investment styles and fund structures will be in favour at different times. A case in point at this review was that actively managed North American funds have underperformed the index which has lowered all ratings of active funds, but this doesn’t mean they underperformed other regional equity markets, in fact, the opposite is true. If funds don’t make our criteria, they are placed on watch and are monitored for improvement. Where some of our risk adjusted metrics like Sortino and information ratios show improvement, we wait for the FE Crown rating to be reviewed before a decision is made.

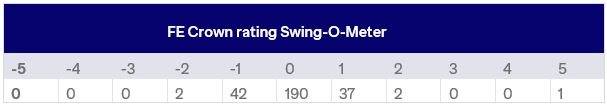

Out of the 295 actively managed threesixty shortlist funds saw the following changes in FE Crown rating since the last review in January 2024.

FE Crown rating swing-o-meter

The table shows 64% of rated funds have had no change in rating since January with only 1% of funds changing by 2 FE Crowns. Having this continuity is useful for adviser firms assessing fund selection, particularly when financial markets are volatile; you need something to cut through the short-term noise. threesixty’s fund selection quants-based process offers firms a complementary resource to support their own fund selection process. The process we use is clearly documented on our research, this can be used as part of a firms’ centralised investment proposition.

The Hotel analogy – The one rating decision

When choosing where to stay on holiday, most of us will go by the star rating on a hotel, but in reality other factors are really important too, such as location, weather, and entertainment. The FE Crown rating system can be seen in a similar way with 5 crowns providing that 5-star stay for your client’s funds, however the truth is more complex. FE themselves highlight that the ratings are “purely quantitative and backward looking” and that other factors both qualitative and quantitative should be considered. This is why threesixty would suggest fund selection has to be conducted using different inputs to achieve the right outcomes for clients.